Is Bitcoin ‘Digital Gold'?

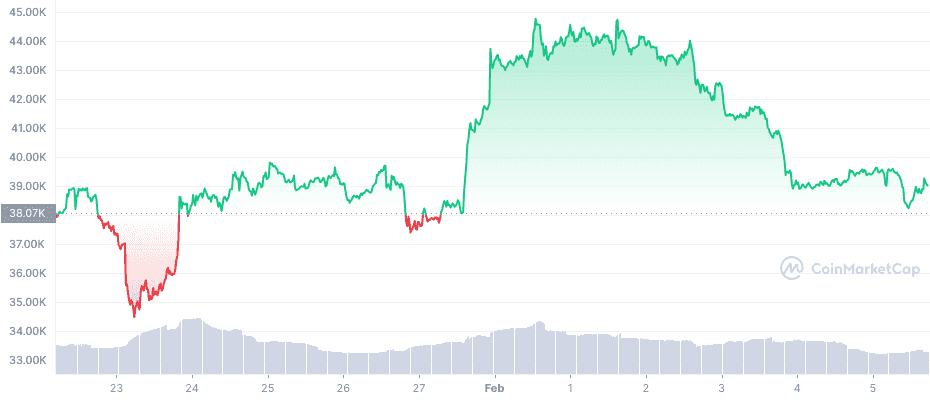

Image: CoinMarketCap

For years, proponents of bitcoin have been calling it “digital gold,” claiming the world’s oldest cryptocurrency can serve as a hedge against global economic uncertainty – just like the precious metal.

🪙 The argument in favor: Unlike fiat currencies or stocks, bitcoin can’t be diluted in times of crisis since there’s only a finite number of coins in existence (its supply is capped at 21 million). Theoretically, this means holding bitcoin is a way to hedge against inflation or a stock market crash, both of which are currently happening in Russia as a result of global sanctions.

🔢 By the numbers… When Moscow attacked Ukraine on February 23, bitcoin immediately fell ~10% before regaining all of that value within a day. On the other hand, gold quickly spiked ~3% before losing all of that value over the next day.

Since the war began, bitcoin has gained 2.6% while gold is up 3.1%.

- Bitcoin trading activity in Russia and Ukraine’s local currencies reached its highest levels in months last week. Crypto donations to Ukraine have now surpassed $83.5 million, with more than half of that sum going directly to the country’s government.

✋ Yes, but… While it appears crypto has seen a resurgence due to the conflict in Ukraine, many are still hesitant to call bitcoin "digital gold." Instead, they argue that it’s acted more like a tech stock in recent years.

- Despite US inflation being at historic highs, bitcoin has lost more than 40% of its value since a recent peak in November, mirroring falls seen in stocks like Meta and Netflix. The price of gold has increased nearly 10% over that same period.

See the 360° View

Sprinkles in favor of bitcoin as ‘digital gold’

- Some commentators argue that bitcoin and gold share many similar characteristics, including built-in rarity, high transparency, high liquidity, and great baseline value.

- Others point out that the Russia-Ukraine conflict has prompted the price of crypto to become relatively disconnected from the stock market, which they contend means crypto acts like ‘digital gold’ in times of global crisis.

“Historically, gold has been considered a safe-haven asset. During a financial crisis or recession, the yellow metal has been often used as a hedge against stock market volatility. Bitcoin, meanwhile, has been dubbed “digital gold” in the past and it’s a fair comparison with gold as they share similar characteristics…

While Bitcoin may not be a safe-haven asset yet, it has the potential to become one, since it is expected to increase in value and retain it during times of economic turbulence owing to its uncorrelated status…

The two assets have a few things in common:

Rarity: Both gold and bitcoin are scarce resources and cannot be printed like money. It is predicted that by 2140, all 21 million Bitcoin would be in circulation due to mining.

Transparency: Gold has an established system of trading, weighing and tracking, which is precise… Bitcoin is also difficult to corrupt, thanks to its encrypted, decentralized system and complicated algorithms, making it one of the most secure systems being developed for the future as it is tough to manipulate.

Liquidity: Both gold and bitcoin have very liquid markets and can be exchanged for fiat money.

Baseline Value: Gold has myriad applications from luxury items like jewellery to specialized applications in dentistry, electronics and more. In addition to ushering in a new focus on blockchain technology, bitcoin itself has tremendous baseline value as well. Billions of people around the world who lack access to banking infrastructure and traditional means of finance, can send value across the globe for close to no fee.

That said, Bitcoin's true potential as a means of banking for those without access to traditional banks is yet to be fully developed.”

Sprinkles against bitcoin as ‘digital gold’

- Some commentators argue that bitcoin and gold share many similar characteristics, including built-in rarity, high transparency, high liquidity, and great baseline value.

- Others point out that the Russia-Ukraine conflict has prompted the price of crypto to become relatively disconnected from the stock market, which they contend means crypto acts like ‘digital gold’ in times of global crisis.

“If there were a time for Bitcoin to shine, a geopolitical crisis would seem to be it.

After all, Bitcoin's biggest backers argue that the cryptocurrency is a necessary alternative to fiat currency because central banks and governments can't be trusted and government-backed currencies lose value through inflation.

In theory, Bitcoin solves both of those problems as a decentralized currency on the blockchain with a mathematically limited supply at 21 million. In practice, it's not so simple.

When Russia invaded Ukraine on Wednesday night, the price of Bitcoin didn't jump as the bullish logic would suggest. Instead, it crashed, falling more than 4% in just 30 minutes.

It's true that Bitcoin recovered those losses later on Thursday, but that was only after other risk assets came storming back…

While risk assets like Bitcoin and tech stocks initially flopped, gold rallied, with spot prices jumping 3% as war broke out. Though Bitcoin bulls like to refer the world's largest cryptocurrency as "digital gold," the recent price action on Bitcoin belies that notion, showing that it isn't the safe haven asset it's often billed as…

That a geopolitical upheaval sent Bitcoin holders fleeing for safer assets, rather than causing them to double down on a currency that's supposed to be a solution to the problems with fiat currency, demonstrates that Bitcoin functions primarily as a form of speculation rather than a currency or safe haven. If that weren't true, investors wouldn't be afraid to hold it during uncertain times, and Bitcoin wouldn't be so volatile to begin with.”

Share this!

Recent Discussion stories

Discussion

| March 4, 2022Israel Pauses Sheikh Jarrah Evictions

🇮🇱🇵🇸 Israel's Supreme Court temporarily suspended the evictions of several Palestinian families from homes in an East Jerusalem neighborhood this week; the disagreement over property in the Sheikh Jarrah neighborhood is often described as a microcosm of the broader Israeli-Palestinian conflict.

Discussion

| March 2, 2022Into Year 2: The Biden Administration's Report Card

🏛️ President Biden gave his first State of the Union address yesterday, with his remarks focusing largely on the economy and Russia’s invasion of Ukraine. We’re now more than a month into the second year of his administration – and what does America think of Biden’s presidency so far?

Discussion

| February 28, 2022Biden’s Supreme Court Nominee

👩⚖️ President Biden nominated Ketanji Brown Jackson to the Supreme Court yesterday to replace retiring Justice Stephen Breyer, 83, who will step down this summer.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete