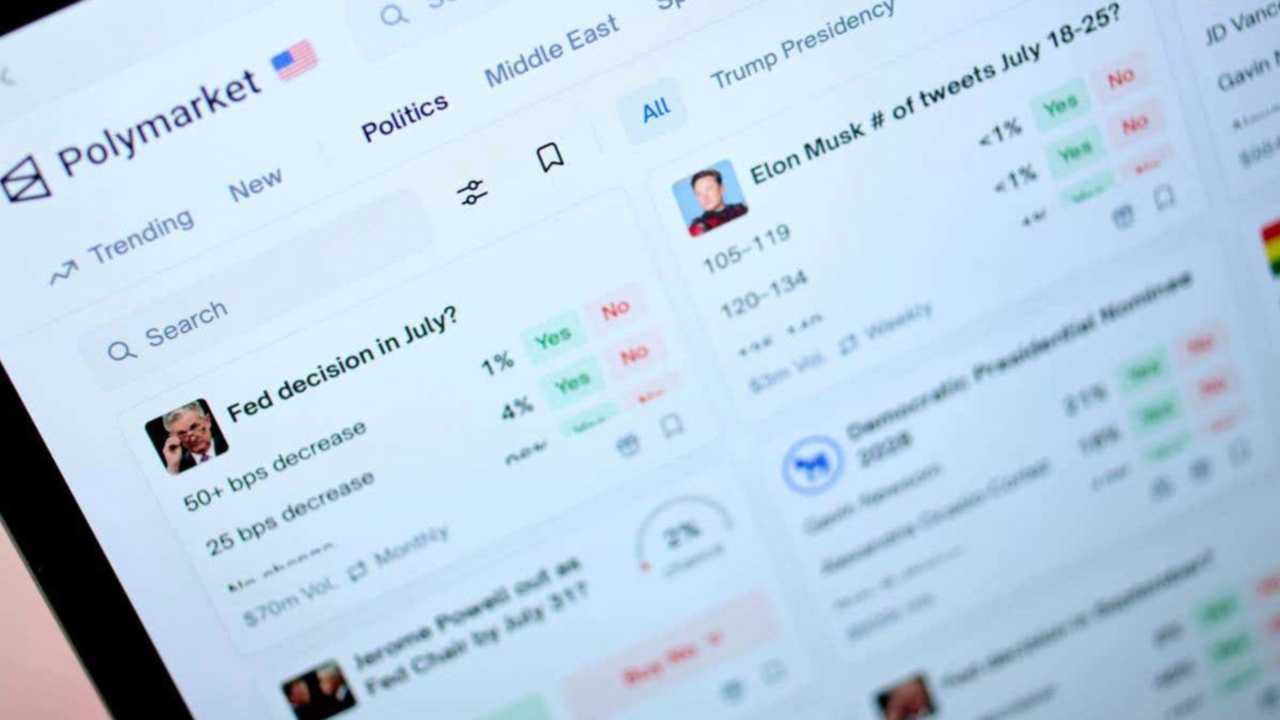

Wanna bet?: Inside the rapid rise of prediction markets

Image: Bloomberg

We’ve all had that moment of thinking: “There’s a 0% chance this meeting ends on time.”

Prediction markets, one of the fastest-growing trading segments in the US economy, turn that same gut feeling into a financial instrument, except the stakes are a bit higher than office resentment.

How prediction markets work

Platforms like Kalshi or Polymarket—and similar offerings from Robinhood, DraftKings, FanDuel, and more—essentially represent stock markets for future events. Instead of buying shares in companies, users buy contracts tied to yes‑or‑no outcomes like: “Will inflation fall below 3% this year?” or “Will Trump win the election?”

Each contract trades between $0 and $1. The price reflects investors’ estimate of how likely an event is to happen: $0.20 implies a 20% chance, while $0.90 implies 90%. If the event happens, the winning contract pays out $1.

- Unlike conventional sportsbooks, prediction markets don’t act as the house and pay out to winners.

- They instead match buyers and sellers on both sides of a question and make money via transaction fees, a structure supporters say creates unusually honest forecasts.

- Prediction markets are legal across America, and aren’t covered by laws in 28 states that ban online gambling.

All bets are on

Once a niche tool for political junkies, prediction markets have exploded into the mainstream. Nearly $12 billion traded across Kalshi and Polymarket in December alone, up more than 400% from a year earlier.

That surge has caught the attention of major media companies in recent months.

- Kalshi partnered with CNN and CNBC to integrate their real‑time probabilities into news reports and live broadcasts.

- Polymarket struck a distribution deal with Dow Jones, making its data available across the Wall Street Journal, Barron’s, and other media outlets.

- Google now shows prediction‑market odds in its search results and finance tools.

It’s also attracted negative attention. Critics of the growing prediction market industry—including conventional casino operators and state regulators—argue prediction markets blur the line between forecasting and gambling, and technically violate state anti-gambling laws.

- Detractors also cite worries about the possibility of insider trading and market manipulation.

- In one high‑profile case, an anonymous Polymarket user placed a large bet that Venezuelan President Nicolás Maduro would fall just hours before he was captured, earning a $400,000+ payday and raising questions about potential insider info.

Supporters counter that prediction markets are fundamentally different from sportsbooks and provide real-world value, with odds that typically outperform traditional polls. “People don’t lie when money’s involved,” says Kalshi co-founder Tarek Mansour.

Big picture: Investors are betting big on prediction markets themselves. Kalshi recently raised new funding at an $11 billion valuation, while Polymarket is valued around $9 billion after new backing from Intercontinental Exchange (which owns the NYSE).

📊 Flash poll: Have you ever used a prediction market like Kalshi or Polymarket?

+Note: Kalshi is a sponsor of DONUT Press Media. Our newsroom is kept 100% separate from our advertising operations.

See a 360° view of what pundits are saying →

Sprinkles from the Left

- Some commentators argue that prediction markets, and their recent contracts with news networks like CNN and CNBC, are ushering in a world in which news reporting becomes as much about gambling as about the event itself—all while it’s unclear whether these sites are actually meaningful predictors.

- Others contend that while prediction markets swear they aren’t gambling, their product sure seems a lot like betting, and it’s clear that more oversight is needed even if the Trump admin is unwilling to provide it.

- “America Is Slow-Walking Into a Polymarket Disaster” –Saahil Desai, The Atlantic

- “Unregulated gambling on politics: What could go wrong?” –Sara Pequeño, USA Today

- “Who used the Maduro raid to earn $400K? The pool of suspects is alarming.” –Rep. Ritchie Torres (D-NY)

Sprinkles from the Right

- Some commentators argue that the rise in popularity of prediction markets across the US is due to major underlying issues with US society where certain American fundamentals—like strong institutions, affordable education, accessible homeownership, and stable work—are buckling.

- Others contend that prediction markets need to address certain fundamental issues to remain attractive to typical US investors, including the fact that insider trading is not only allowed but encouraged on these platforms.

- “Why My Generation Is Turning to ‘Financial Nihilism’” –Kyla Scanlon, WSJ

- “Why Prediction Markets Need Insider Trading” –Alicia Park, Forbes

- “A serious threat to Utah’s anti-gambling stance” –Jay Evensen, Deseret News

Share this!

Recent Discussion stories

Discussion

| January 21, 2026Inside Trump’s push for the US to acquire Greenland

In recent days, President Trump ramped up a pressure campaign against America’s military allies in Europe as part of his renewed push for the US to acquire Greenland from Denmark.

Discussion

| January 16, 2026The rise of AI data centers sparks an electricity dilemma

If your electricity bill spiked because of a warehouse full of AI servers that guzzle power faster than your nephew’s soccer team slamming Gatorade at halftime, you wouldn’t be too happy.

Discussion

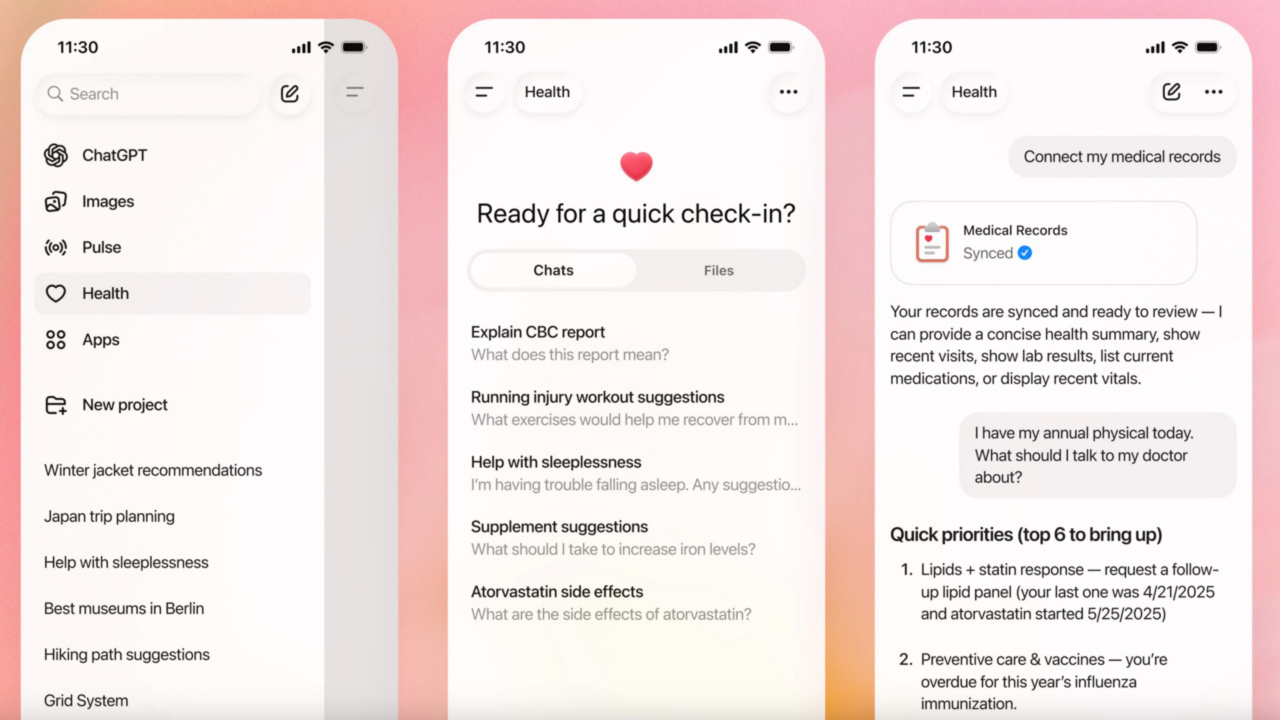

| January 14, 2026ChatGPT wants to give users health advice

OpenAI last week soft-launched ChatGPT Health, a new feature that connects to your apps and medical records to give personalized medical advice.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete