Peloton’s Not Doing So Hot

Image: Tenor

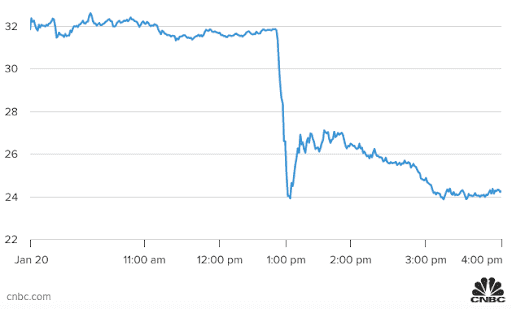

🚲 The connected fitness company will temporarily halt production of its exercise bikes and treadmills, CNBC first reported yesterday. Its stock closed the day down 24%, falling briefly below its IPO price and wiping $2.5 billion off its market value.

- Starting in February, Peloton will make zero new bikes or treadmills for at least six weeks – and will hold off even longer for products like the Bike Plus, Tread, and Tread Plus (which has had some big safety issues).

- Peloton essentially misjudged consumer demand for its products. It currently has thousands of cycles and treadmills sitting in warehouses or on cargo ships, and it needs to reset its inventory levels.

- When gyms closed earlier in the pandemic, the company couldn’t manufacture enough bikes to meet its demand. But now it has the opposite problem – gyms have reopened, and people just aren’t buying at-home fitness equipment like they used to.

- On Tuesday, CNBC reported that Peloton hired consulting firm McKinsey to help it slash costs. Some of the top execs at the home workout empire have reportedly discussed laying off 41% of the sales and marketing teams, slashing underperformers in the e-commerce department, and closing retail locations.

👁 Looking ahead… There may be more trouble on the horizon. Peloton’s latest forecast doesn’t take into account any impact it might see when it begins to charge customers hundreds in delivery and setup fees later this month (inflation strikes again).

+A slight contrast: Peloton’s stock increased more than 440% in 2020, but dropped ~80% last year.

+For those wondering what time the news broke: If you squint and look close, you just might see it. 👇

Share this!

Recent Business & Markets stories

Business & Markets

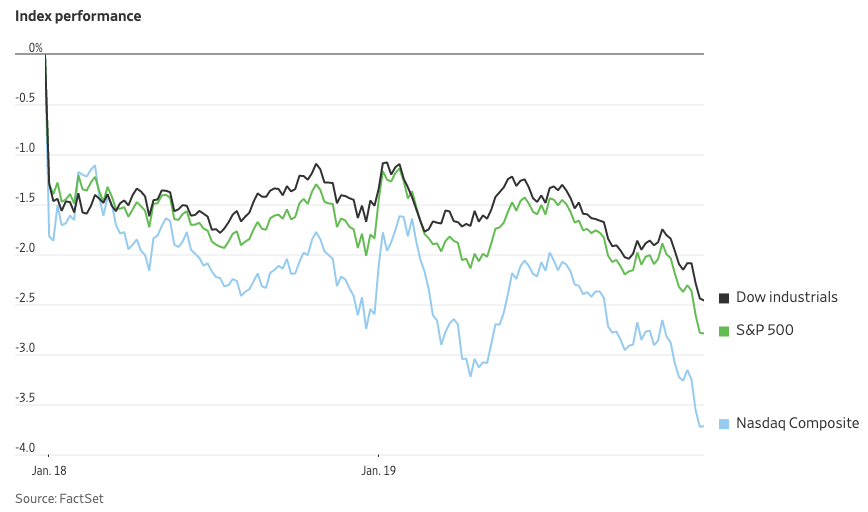

| January 20, 2022Nasdaq Enters Correction Territory

US markets continued their decline yesterday. The Nasdaq entered what’s known as correction territory, falling more than 10% from its recent peak in November. The Dow and S&P also dropped 1% apiece.

Business & Markets

| January 19, 2022Microsoft Flexes Its Gaming Muscles

Microsoft agreed to buy Activision Blizzard – maker of Call of Duty, World of Warcraft, Candy Crush, and more – in an all-cash deal valuing the video game publisher at $68.7 billion. Microsoft plans to add many of Activision’s games to Xbox Game Pass once the deal closes.

Business & Markets

| January 18, 2022Walmart Has Entered the Chat

Walmart filed several new trademarks late last month indicating plans to start selling virtual goods, including its own crypto and collection of NFTs, joining a growing list of retailers taking part in the metaverse movement.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete