Insider Trading is Bad, Mmmkay?

Image: South Park

🕵️ The SEC has been investigating whether Tesla CEO Elon Musk and his brother violated insider trading rules, according to the WSJ. At the center of the issue? A Twitter poll from Elon last November asking if he should sell Tesla shares.

- Kimbal Musk sold Tesla shares worth $108 million one day ahead of Elon’s poll. 58% of respondents said he should sell, which caused the share price to fall sharply. Elon sold off billions of dollars worth of stock in the following days.

- The key question for regulators is whether Kimbal learned about his brother’s upcoming tweet or the timing of his sales – either from Elon himself or other sources – ahead of Kimbal’s own $108 million sell-off, which was his largest ever in terms of value (2nd place: $25 million).

- By law, employees and directors of public companies are generally banned from buying or selling shares when they’re aware of nonpublic material information, but can avoid insider trading charges when they buy or sell using a preset trading plan.

- Kimbal serves on Tesla’s board of directors, and had not previously indicated any plans to sell shares in this case.

🇺🇸 Zoom out: There’s a growing movement in the US to crack down on influential individuals trading stocks with insider knowledge. The Federal Reserve issued new guidelines last week banning its top officials from buying and holding a wide range of investment products starting May 1.

Earlier this month, House Speaker Nancy Pelosi (D-CA) said she’d support a bill to ban lawmakers – and potentially other government leaders – from trading stocks. The legislation is expected to be put up for a vote this year.

Share this!

Recent Business & Markets stories

Business & Markets

| February 23, 2022Yesterday Was a Big Day for Construction

🏥🧬🛠 Mayo Clinic, Eli Lilly and Home Depot make some waves.

Business & Markets

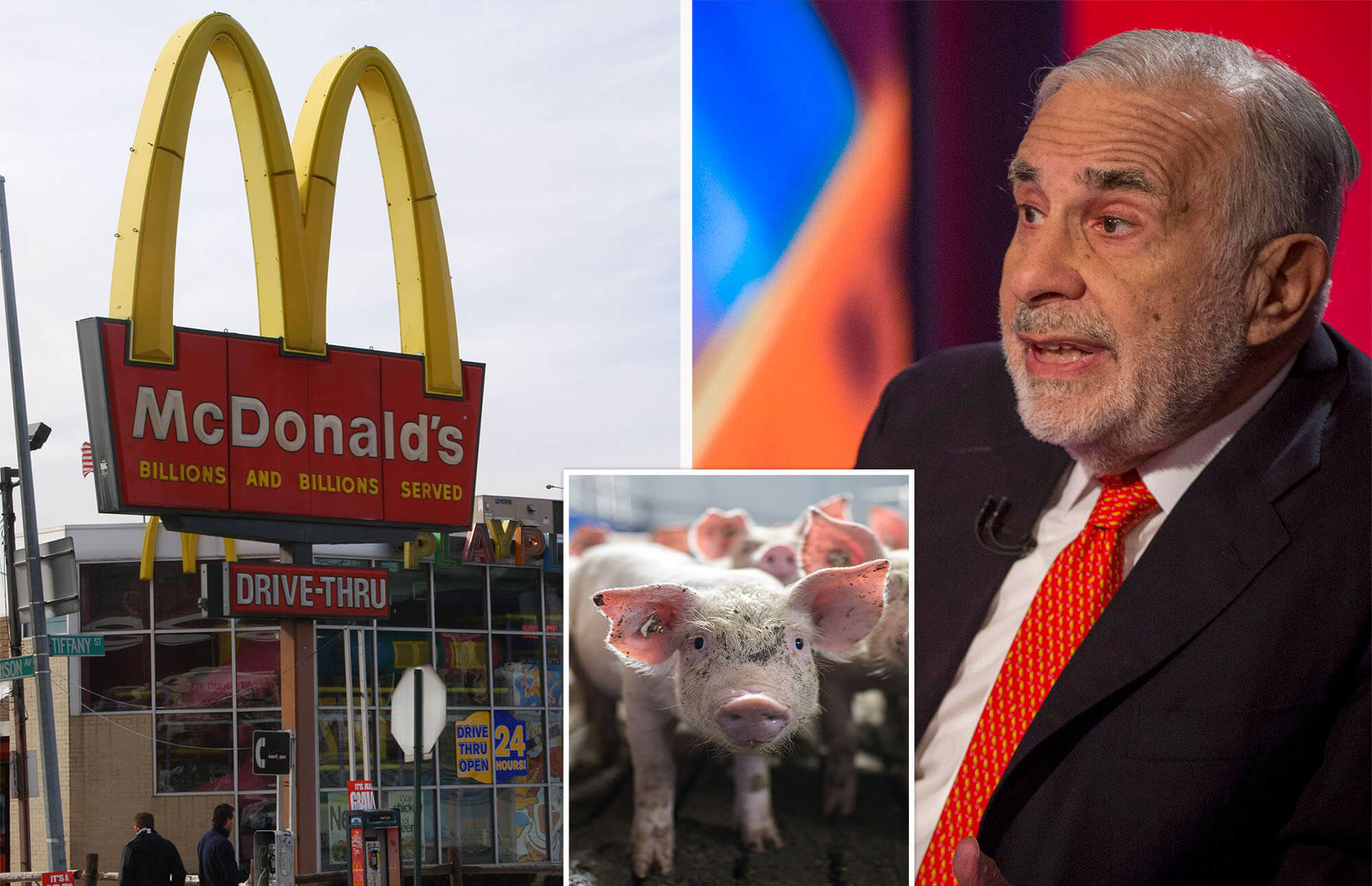

| February 22, 2022How the Sausage is Made

🐷 McDonald’s on Sunday confirmed that billionaire activist investor Carl Icahn has nominated two members to its board of directors in a push to change the way the company’s pork suppliers treat pregnant pigs.

- In 2012, McDonald’s promised to phase out the practice of keeping pregnant sows in small gestational crates. The WSJ revealed earlier this month that Icahn had quietly pushed for that change behind the scenes.

- Now, the Humane Society and Icahn – whose daughter used to work there – are claiming the fast-food giant is simply working to reduce the practice, rather than end it.

- In a statement, McDonald’s said it expects to source 85% to 90% of its US pork volumes from “sows not housed in gestation crates during pregnancy” by the end of this year, and 100% by the end of 2024.

- The company also mentioned that Icahn is a majority owner of pork supplier Viskase and hasn’t publicly called on them to adopt similar commitments.

🧠 In the know: Icahn reportedly owns just 200 McDonald’s shares (worth ~$50,000). The activist investor typically acquires eight- or nine-figure stakes in the companies he targets.

It’s unusual for activist investors with such a small stake to gain traction. But last spring, a hedge fund called Engine No. 1 won three seats on Exxon Mobil’s board – despite a 0.02% stake in the company – after arguing it should commit to carbon neutrality.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete