A Look at Yesterday’s Fed Meeting

Image: The Office

🏦 The Fed’s Open Market Committee voted to raise interest rates by 0.25% following the conclusion of its two-day meeting yesterday afternoon, the first increase in over three years.

- The rate hike was approved by an 8-to-1 margin, with the lone dissenting vote pushing for a 0.5% increase instead.

- The committee also updated its projections for this year’s GDP (from 4% to 2.8%) and overall inflation (from 2.7% to 4.1%).

- Fed officials indicated an aggressive path ahead, with plans to increase rates again after each of the six official meetings left this year. If carried out, this would result in a minimum 1.75% increase by the end of the year; rates currently range from 0.25%–0.5%.

📸 The big picture: The Fed’s decision to raise the overnight rate on lending between banks will have a domino effect on borrowing costs throughout the entire US economy.

You can expect to see higher rates on mortgages, credit cards, student loans, saving accounts, corporate debt and more. How much those rates increase will depend on how investors, businesses and households respond.

+Dig deeper: From the Left | From the Right | What exactly is the role of the Federal Reserve?

Share this!

Recent Business & Markets stories

Business & Markets

| March 16, 2022Rideshare Prices Are Going Up (Slightly)

🚘📈 Starting today, prepare to pay a little extra for Ubers and UberEats orders.

Business & Markets

| March 15, 2022The Supply Chain Probably Isn’t Clearing Up Anytime Soon

🇨🇳 China has ordered roughly 51 million people into Covid lockdown for at least a week, impacting its entire northeastern province of Jilin and the southern tech and manufacturing hubs of Shenzhen and Dongguan. It's the largest full-scale lockdown since Wuhan and its neighbors did so in early 2020.

Business & Markets

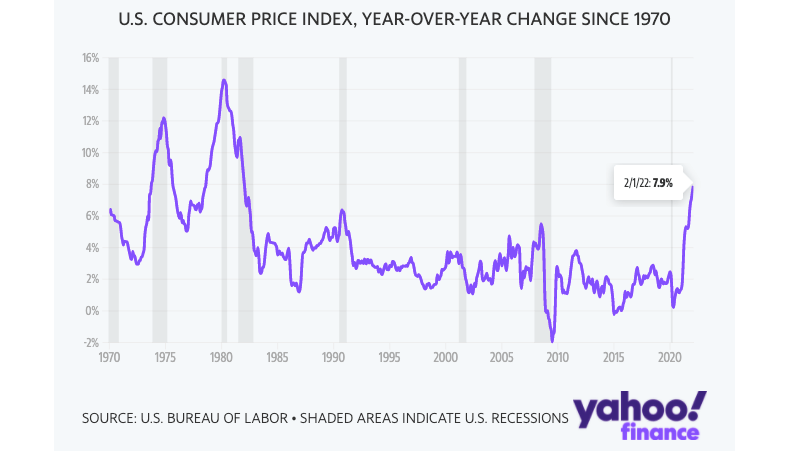

| March 11, 2022Another Historic Inflation Report

💵📈 The Consumer Price Index, the most widely used measure of inflation, saw its highest annual gain in 40 years last month, increasing 7.9% compared to a year ago.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete