It Was a Rough Day on Wall Street Yesterday

Image: Community

In a reversal of Wednesday’s rally, US investors sold off ~$1.3 trillion worth of stocks in the market's worst day since the pandemic first began.

🔢 By the numbers…

- The S&P 500 lost 3.6%, its second-worst performance of the year. The Dow dipped 3.1%, and the Nasdaq closed down nearly 5% – both of which represent the worst single-day drops since 2020.

- E-commerce stocks were hit especially hard. Several major players reported subpar earnings, including Etsy (-17%), eBay (-12%), Shopify (-15%) and Wayfair (-26%).

- Large tech stocks didn't have too much fun either, with Meta (-7%), Amazon (-8%), Microsoft (-4%) and Apple (-6%) all contributing to the major indexes’ declines.

📸 The big picture: Investors are facing the most aggressive tightening of US monetary policy in over two decades after the Fed raised interest rates by 0.5% this week. But Thursday’s results show traders are predicting that the central bank “will struggle to fight high inflation amid the lingering threat of a recession,” per Bloomberg.

+In the know: Higher interest rates usually lead to slower (or negative) growth for tech stocks because it reduces the value investors place on their future earnings. Generally speaking, fixed-income assets like bonds gain a boost in attractiveness compared to riskier assets like stocks.

Share this!

Recent Business & Markets stories

Business & Markets

| May 5, 2022Women Secure a Record Number of New Board Appointments

👩💼 Women made up nearly half of all new Fortune 500 board appointments last year (45%) – an all-time high, according to a new report from executive search firm Heidrick & Struggles.

Business & Markets

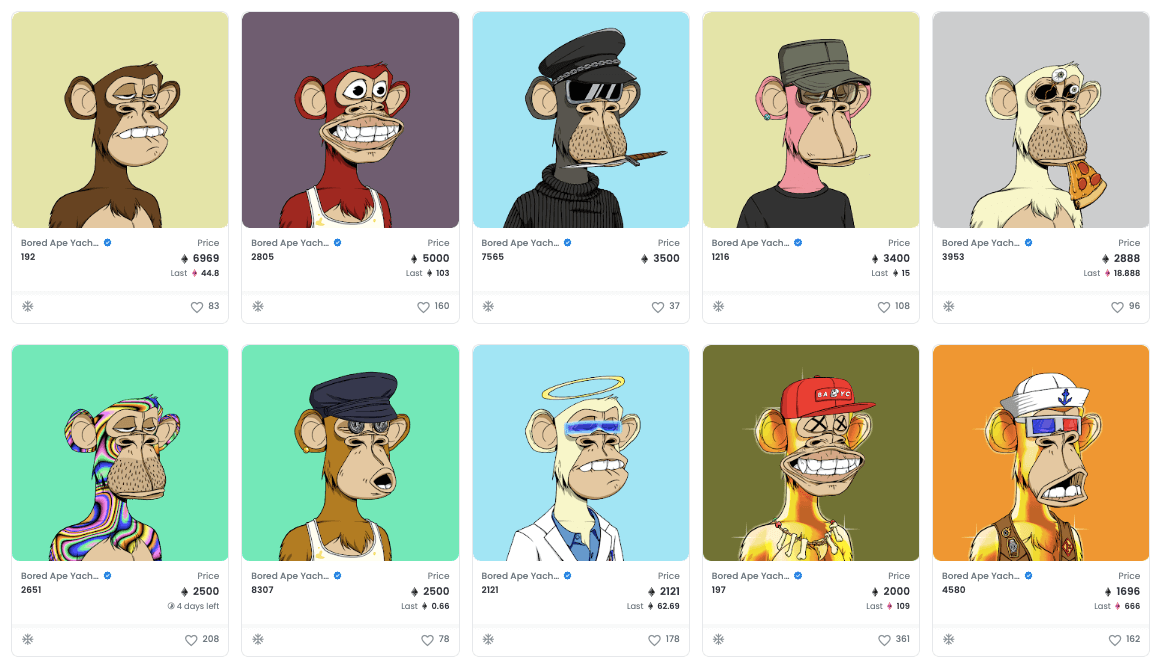

| May 5, 2022WTF Is Up With NFTs?

📉 The sale of NFTs fell to a daily average of about 19,000 this week, a 92% decline from a peak of ~225,000 in September, according to data gathered by the WSJ.

Business & Markets

| May 5, 2022Interest Rates Are Going…

📈 The Fed’s Open Market Committee voted to raise interest rates by 0.5% following the conclusion of its two-day meeting yesterday afternoon, its largest hike since 2000.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete