Masks and snorkels, on – we’re diving into the US economy

Image: Johns Hopkins University

At the tail-end of last year through the beginning of this year, a supermajority of experts were predicting the US was headed for an upcoming recession, in addition to 97% of corporate executives.

But things haven’t quite turned out that way.

In fact, outside of baseline interest rates – which the Fed raised to a 22-year high yesterday afternoon – many economic indicators have been trending in a positive direction for months:

- The labor market remains surprisingly strong. The US economy added an average of 235,000 jobs each month so far this year, bringing the unemployment rate down from 4.0% in January to 3.6% today. And prior to last month’s jobs report, economists had underestimated the amount of US job growth for 15 straight months.

- Inflation has continued to decline. Annual US inflation stood at 3.0% in June, down from 7.5% in January. Last month marked the lowest reading in over two years, and the 12th straight month inflation has fallen.

- All three major stock indexes are in a bull market. The Dow has been in a bull market – aka at least 20% higher than its most recent low – since last November, while the Nasdaq and S&P 500 entered bull markets in May and June, respectively.

- The IMF increased its previous estimate for 2023 US GDP. In a report published Tuesday, the IMF raised its outlook for 2023 US GDP growth by 0.2 percentage-points to 1.8%, citing a strong domestic labor market.

- Consumer confidence is at its highest point in two years. The Conference Board’s monthly consumer sentiment index, published Tuesday, found Americans of all ages and all income brackets have greater confidence in the US economy now as compared to the start of this year.

✋ Yes, but… Like an iPhone that’s been dropped over and over again, the US economy is showing some cracks, too. Core inflation remained relatively high in June (4.8%), meaning consumers are still seeing elevated prices for transportation, medical services, housing, and other essential products.

Plus, it typically takes at least 12 months before the full impact of the Fed’s interest-rate hikes is felt across the US economy, as consumers and companies adapt to higher rates for mortgages, credit cards, government bonds, etc.

🗣️ Zoom out: The US economy’s performance should become even clearer over the next few weeks, as dozens of major companies across the tech, banking, retail, health, energy, automotive, and other industries report quarterly earnings.

Share this!

Recent Business & Markets stories

Business & Markets

| July 26, 2023A new type of avocado is coming to the market

🥑 After decades of research and development dating back to the 1950s, agricultural scientists at UC Riverside recently unveiled the Luna UCR – a brand-new type of avocado.

Business & Markets

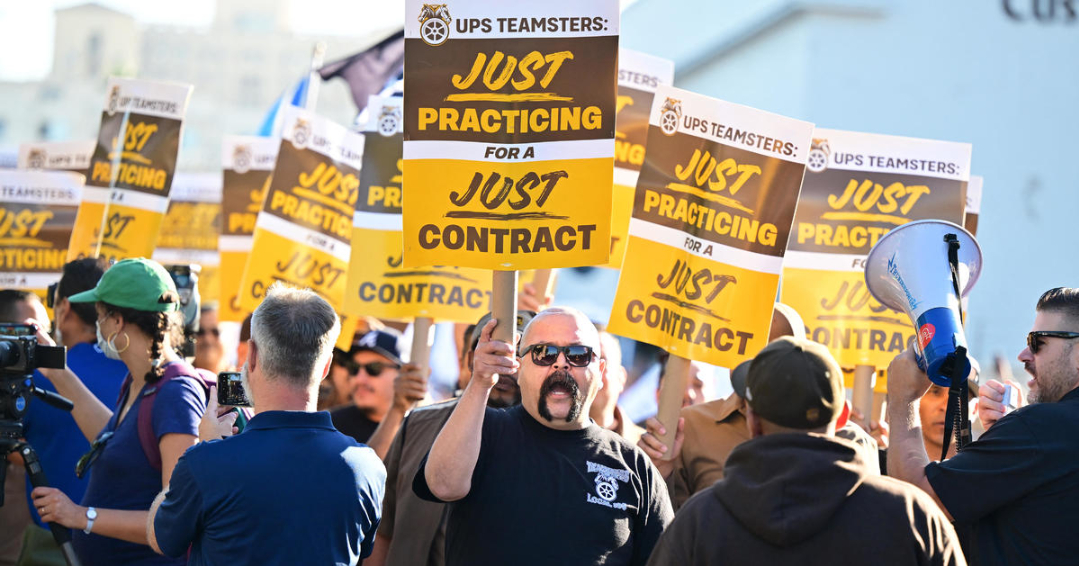

| July 25, 2023The potential impact of the looming UPS strike

🟤🤝🚚 Later today, UPS and the Teamsters Union, which represents 340,000 UPS workers, will once again be sitting across the negotiating table. And the stakes are high – the two sides will be working to avert America’s biggest strike in 60 years.

Business & Markets

| July 21, 2023America has some serious wanderlust

✈️ American Airlines, Delta, and United all posted record quarterly earnings over the past week.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete