America’s latest inflation report card just dropped

Image: Gabriel Cortes/CNBC

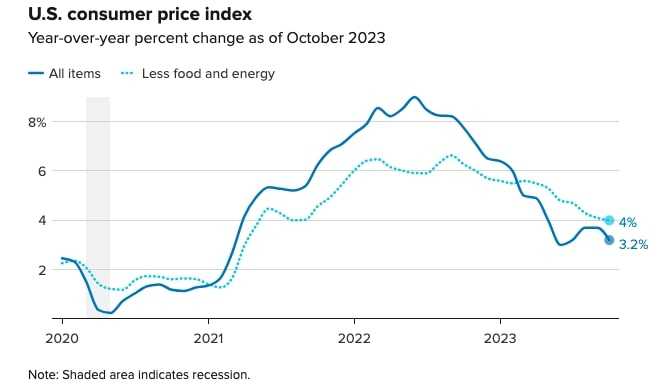

The Consumer Price Index, America’s most widely-used measure of inflation, is pulling its best Wright brothers impression and slowly gliding back down to Earth after reaching historic heights.

According to Labor Department figures published yesterday, US inflation stood at 3.2% over the year-long period ending in October, down from 3.7% in September.

- Core inflation – which excludes often-volatile food and energy prices – stood at an annual rate of 2.8% for the five months ending in October, compared to 5.1% during the first five months of this year.

- Analysts attribute the recent trend to falling prices for cars, fuel, and airfares, as well as slower growth in housing costs.

The market reacts: At the start of trading yesterday morning – exactly one hour after the CPI was released – all three major US indexes opened significantly higher than Monday’s closing price. Stocks remained at elevated levels for the rest of the trading session, with the S&P 500 notching its best single-day performance since April (S&P: +1.9% | Dow: +1.4% | Nasdaq: +2.4%).

👀 Looking ahead… The Fed, which raised interest rates to a 22-year high this summer to combat inflation, is widely expected to hold rates steady for a sixth straight month in response to yesterday’s inflation report. Analysts also say the better-than-expected CPI figures reduce the chances of additional rate hikes early next year.

Share this!

Recent Business & Markets stories

Business & Markets

| November 14, 2023Exxon Mobil is betting big on lithium

⚒️🔋 Exxon Mobil is planning to become a major lithium supplier for EV battery-makers by the end of this decade, after recently acquiring rights to a vast lithium mine in Arkansas.

Business & Markets

| November 8, 2023How WeWork’s demise could affect banks and major cities

🏢📉 WeWork, the office coworking company once valued at $47 billion, filed for bankruptcy this week. And this move could have a negative ripple effect on the commercial real estate and banking industries, as well as municipal revenues.

Business & Markets

| November 7, 2023Bumble has a new queen bee

📱🐝 Bumble founder and chief executive Whitney Wolfe Herd is stepping down as the company’s CEO.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete