Behind the typo that lyfted Lyft

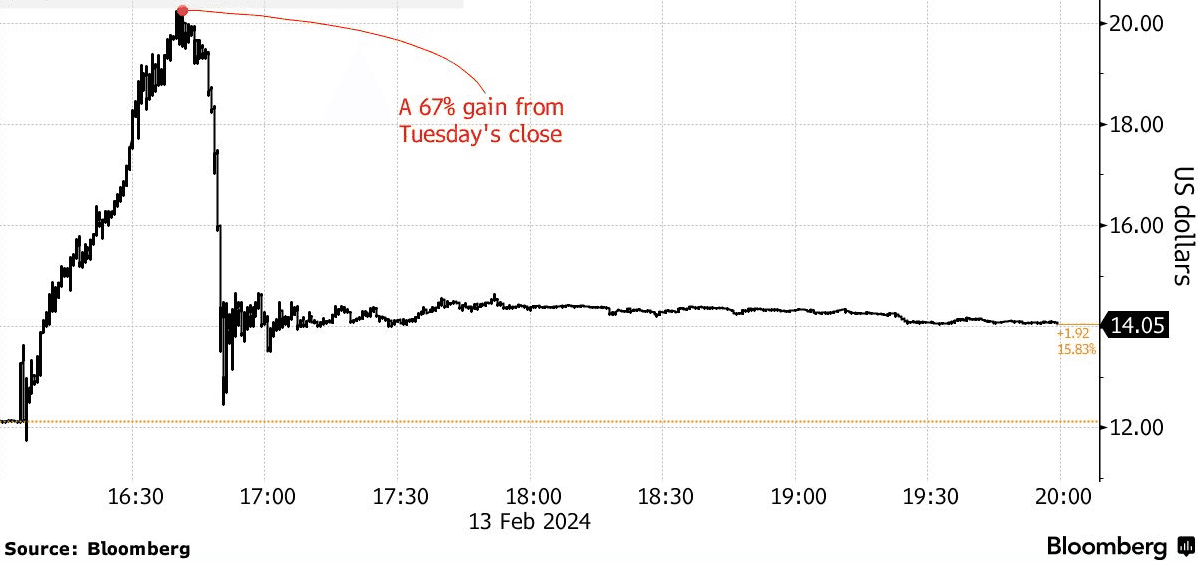

Lyft shares hit a 52-week high yesterday after reporting earnings that showed its best financial quarter in history – and also contained a major typo that appears to have sent investors' trading algorithms into a buying frenzy.

Here’s what happened: When Lyft initially published its Q4 earnings report Tuesday afternoon, it forecast that a key profit metric called “margin expansion” was expected to climb by 500 basis points, or 5%, in 2024.

- However, minutes after the original release, the company informed investors that its margin expansion projections contained one zero too many and corrected the number to 50 basis points, or 0.5% growth.

But the damage was already done

In today’s stock market, many trades are executed by high-tech algorithms that react to new financial information in fractions of a second. And when these algorithms saw Lyft’s typo indicating a far-better-than-expected outlook for 2024, they started Hulk-smashing the buy button.

- Lyft’s shares rose nearly 70% in after-hours trading almost immediately after the initial earnings report was published – then fell sharply back to +16% after Lyft said its positive 2024 outlook was overstated, wiping out over $2 billion in market cap.

- But, even without the typo, Lyft’s Q4 earnings report was good enough for many investors to buy back in. The company’s stock closed trading yesterday up 35%, a figure that includes Tuesday’s after-hours bonanza.

😬 Mistakes, mistakes: Lyft joins a handful of other major companies in recent years that have published typos impacting their stock-price. These include cybersecurity firm Crowdstrike forecasting revenue of $38.6 million instead of $138.6 million (-6% stock drop), and now-defunct pharma company Galena forgetting the word “not” while saying it was the target of an investigation into over-prescribing of a painkiller (-3%).

Share this!

Recent Business & Markets stories

Business & Markets

| February 14, 2024The big business of Valentine’s Day

💰❣️ It’s Valentine’s Day, and Americans are breaking out their wallets. US consumers are expected to spend a total of $25.8 billion to celebrate the holiday, according to recent data from the National Retail Federation.

Business & Markets

| February 13, 2024Chocolate is about to get more expensive

🍫📈 Last week, cocoa prices rose again to break the all-time record from 1977, the year before Reese’s Pieces were introduced to the masses (😋) – meaning chocolate is about to get more expensive.

Business & Markets

| February 8, 2024US spirit sales outpace beer for the second year in a row

🍺➡️🍸 In 2023, for only the second time in history, US spirit sales surpassed beer sales in terms of market share, per a new report from the Distilled Spirits Council of the United States.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete