EV demand is impacting the battery metals market

Image: Arne Hodalic/The Grist

The prices of metals used in batteries are declining, and lower-than-expected EV demand may be the culprit. According to data reported by the WSJ:

- The price of lithium carbonate – a raw material in batteries – fell 70% in 2023

- The price of cobalt dropped 25%

- Nickel prices decreased 45%

The reason for this drop is right out of Econ 101. When supply goes up and demand goes down, prices tend to mirror demand and decrease. And that’s what’s happening here.

Metal producers in recent years have ramped up new projects in order to supply the burgeoning EV industry – but EV demand from consumers has come in below expectations, leaving many of these producers in an unprofitable position, the WSJ reports. The result: lithium and nickel projects are increasingly being paused. Swiss mining and trading giant Glencore recently announced plans to suspend production at an unprofitable nickel mine and processing plant that provides more than 6% of the world’s supply.

Lower-than-expected EV demand is also impacting legislation. The Biden administration will reportedly soon ease vehicle-emission requirements through 2030 at the urging of automakers and the UAW, who say EV tech is still too costly for many mainstream consumers and that more time is needed to develop a charging infrastructure.

Share this!

Recent Business & Markets stories

Business & Markets

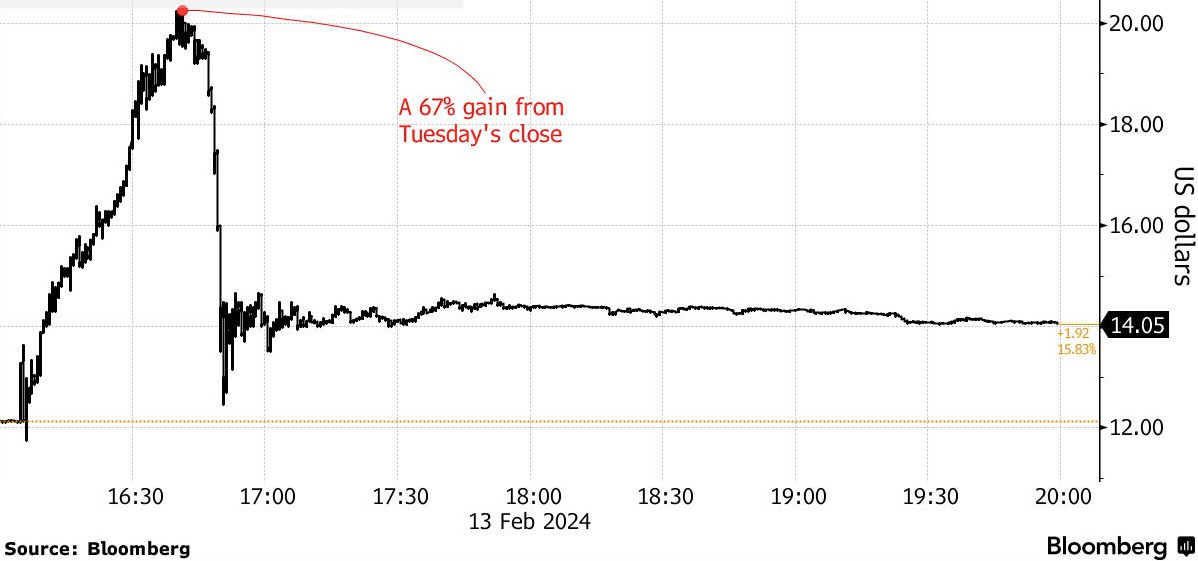

| February 15, 2024Behind the typo that lyfted Lyft

🤭📈 Lyft shares hit a 52-week high yesterday after reporting earnings that showed its best quarter in history – and also contained a major typo that sent trading algorithms into a buying frenzy.

Business & Markets

| February 14, 2024The big business of Valentine’s Day

💰❣️ It’s Valentine’s Day, and Americans are breaking out their wallets. US consumers are expected to spend a total of $25.8 billion to celebrate the holiday, according to recent data from the National Retail Federation.

Business & Markets

| February 13, 2024Chocolate is about to get more expensive

🍫📈 Last week, cocoa prices rose again to break the all-time record from 1977, the year before Reese’s Pieces were introduced to the masses (😋) – meaning chocolate is about to get more expensive.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete