A look at the global battle for chip dominance

Image: Getty

Semiconductors are to electronics what a solid internet connection is to online gaming – essential af. These “chips” are used in almost every electronics sector, ranging from smartphones to radios to advanced medical diagnostic equipment… in addition to various military applications.

And, given how integral this technology is to, well, everything, governments around the world are moving to reduce dependence on foreign manufacturers and boost their respective country’s semiconductor industry. Most recently, China announced it will be phasing out Intel and AMD chips on government computers in favor of China-based competitors – a move that could hurt both US-based companies more than a first heartbreak.

- China was Intel’s largest market last year, providing 27% of its $54 billion in sales.

- As for AMD, China accounted for 15% of its $23 billion in sales.

The US-China divide is becoming more pronounced

China’s announced revamp of its procurement process is part of a new national strategy known as “xinchuang,” or “IT application innovation” – which basically means pushing for technological independence in the military, government, and state sectors. Part of these new rules also include phasing out Microsoft Windows and other non-China made operating systems and replacing them with domestic options.

And, like two rivals shouting at each other from either end of a desert canyon, they echo moves made by the US. America has imposed sanctions on a growing number of Chinese companies on national security grounds, legislated to encourage more tech to be produced in the US, and blocked exports of advanced chips and related tools to China, the Financial Times reports.

Taiwan = the Charlie Kelly-style wildcard of the chips game. Taiwan – a country China has long made clear it wants to bring under its control – held 46% of the world’s semiconductor foundry capacity as of 2023, followed by China (26%), South Korea (12%), the US (6%), and Japan (2%), according to TrendForce.

👀 Looking ahead… The Biden administration has begun to dole out its first major awards from a pool of ~$53 billion allocated in the CHIPS Act (2022) for building up the US semiconductor industry.

But the clock is ticking. Rival countries are offering their own incentives to court chip manufacturers, and the longer the US government waits to distribute benefits, “the more other geographies are going to snap up these investments, and more leading-edge investments will be made in East Asia,” Jimmy Goodrich, a senior adviser for technology analysis to the RAND Corporation, told the NY Times.

Share this!

Recent Business & Markets stories

Business & Markets

| March 26, 2024POV: consumers shopping for Easter candy this week

🍫 Chocolate prices and college students on spring break have something in common – they’re both really high rn. On Friday, cocoa futures closed at a record $8,939 per metric ton, a 12% increase over the previous week and 205% higher than this time last year.

Business & Markets

| March 21, 2024A new Apollo mission just took off from the launchpad

🍿 Apollo Global Management, a private equity firm that owns the majority of Yahoo, has taken one big step for… itself and made an $11 billion offer to buy Paramount Global’s film and TV studio, according to a new report.

Business & Markets

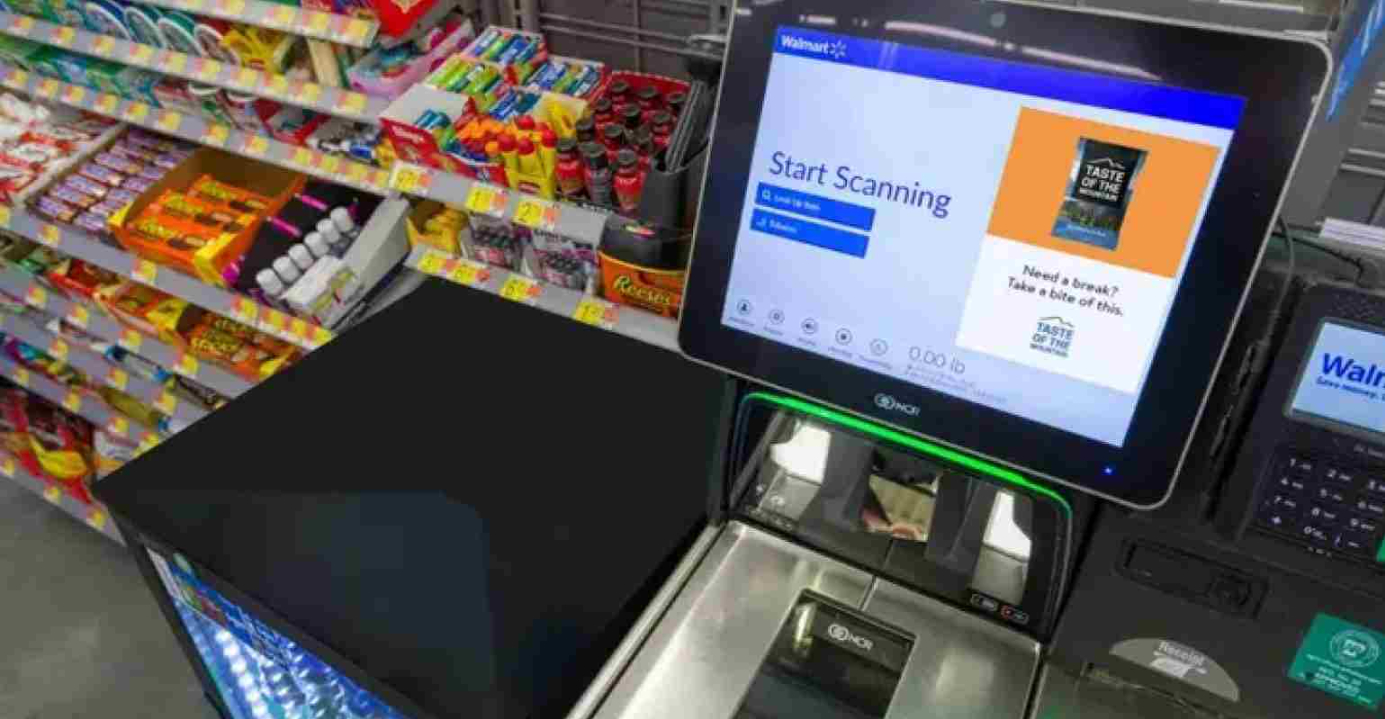

| March 19, 2024Retailers are altering the self-checkout process

🏪 If you have a toddler whose favorite phrase is “I can do it myself!”, you may want to tread lightly at Dollar General, Target, and Walmart.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete