The markets after yesterday’s inflation report

Image: Tenor

The latest inflation data dropped yesterday morning. And it has economists and investors fist-pumping like Tiger Woods at the 2005 Masters.

The US consumer price index increased 3.4% annually in April, in line with economists’ expectations and below March’s 3.5% reading. Core CPI, which excludes volatile food and energy items, rose 3.6% annually, its lowest increase since April 2021.

- On a month-to-month basis, overall inflation rose 0.3% in April, below both economists’ expectations and March’s reading. Housing and gas prices accounted for over 70% of the increase, while medical costs and car insurance prices also rose.

- On the flip side, airline fares, grocery prices, and new and used car prices all fell outright in April.

Big picture: Fed officials and economists started the year with Ms. Frizzle-like optimism about being able to lower interest rates – but the first few months of 2024 generated higher-than-expected inflation readings, making an imminent rate cut (or cuts) less likely.

However, this latest CPI data, while only encompassing one month, indicates inflation isn’t accelerating. And the Fed’s attempt to weaken demand to counteract price increases seems to be working – another report released yesterday showed retail sales stagnating in April.

👀 Looking ahead… Markets are now pricing in a ~77% likelihood of an interest rate cut in September, up from ~65% on Tuesday. And in another sign of investor optimism: the S&P, Dow, and Nasdaq all closed at record highs yesterday.

Share this!

Recent Business & Markets stories

Business & Markets

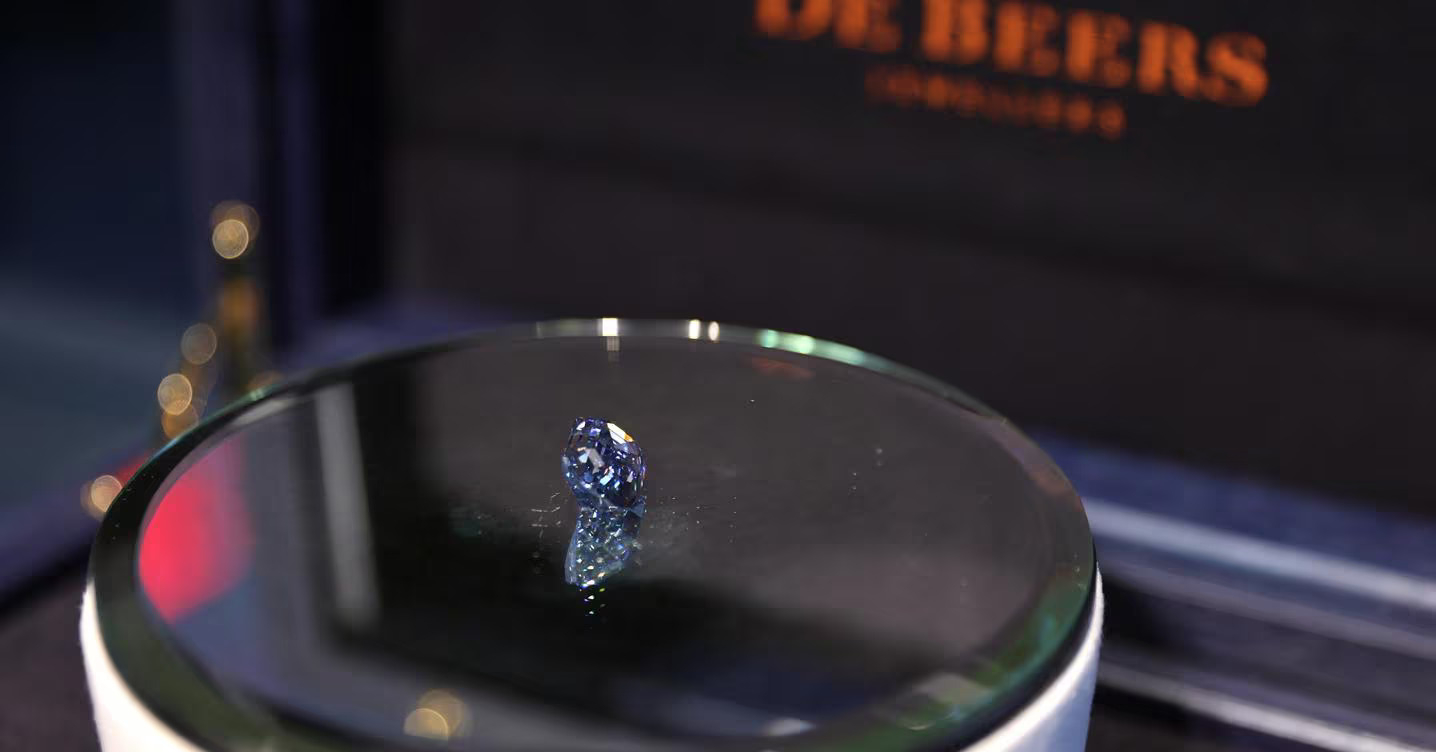

| May 15, 2024With a De Beers spinoff, the diamond industry faces even more uncertainty

Business & Markets

| May 13, 2024TV and streaming are losing the advertising battle to social media and retailers

Business & Markets

| May 10, 2024Sriracha’s OG brand is facing another shortage

🌶️ Huy Fong Foods, the iconic rooster-bottle sriracha brand whose creation dates back to the end of the Vietnam War, has halted production on all of its products.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete