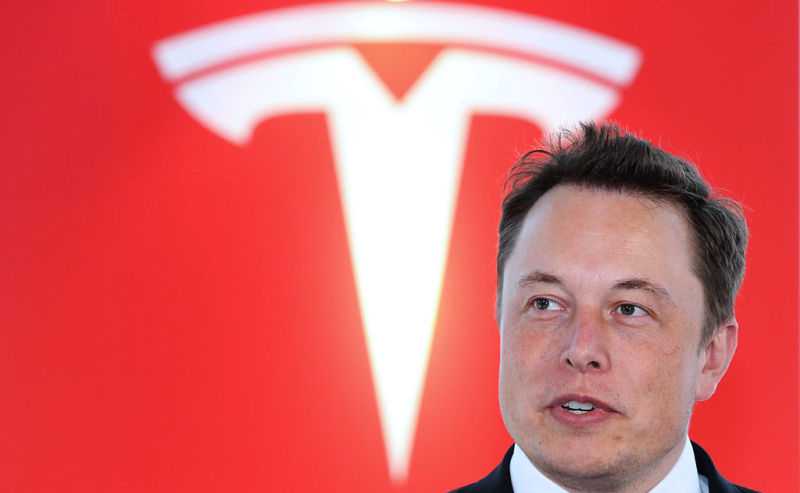

Tesla’s $45 billion vote is here

Image: Getty via ArsTechnica

Today, Tesla shareholders – much like a kid who just got passed a note from their crush – will be faced with a choice: Do you like me? Should CEO Elon Musk receive a ~$45 billion pay package (at current share values)? Check yes or no.

Background: Musk’s pay package previously passed a vote in 2018, with 73% of voted shares supporting it.

But a Delaware judge in January ordered it to be rescinded, ruling that Musk had largely dictated the terms to a board of directors stacked with close friends and his brother, the NY Times reports – which is information shareholders weren’t privy to at the time of the vote, per the judge.

- The disputed pay package, awarded in 2018, gave Musk options for up to 12% of Tesla’s outstanding shares at the time. To cash in, he had to hit strong revenue or profit benchmarks and increase the company’s market cap to $650 billion – goals many thought were out of reach.

- But Tesla, under Musk’s oversight, put on its Elastigirl arms and went to work. At the end of 2018, Tesla’s market cap was ~$57 billion. By the end of 2021, it had reached ~$1.1 trillion (though it’s since fallen to ~$555 billion).

What happens if shareholders vote no? Musk – who has said he’s “uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control” – could walk.

However, Tesla is "determined" to pay Musk for his previous work. And many skeptics point to Musk's 13% stake in Tesla, worth ~$75 billion and accounting for a big chunk of his wealth, as strong reasons to put those boots made for walking back into the closet.

If shareholders vote yes, this doesn’t necessarily mean the package is approved. Tesla plans to use an affirmative shareholder vote as legal ammunition to try and reverse the Delaware judge’s ruling.

It could be close: While some key investors – including California Public Employees’ Retirement System (CalPERS), the largest pension fund in the US, and Norges Bank Investment Management, which manages Norway’s oil wealth and is the world’s largest sovereign wealth fund – have said they intend to oppose the package, while other institutional investors – like Vanguard, BlackRock, and State Street, which collectively own ~17% of Tesla – have been silent. Another wildcard is Tesla’s retail investors, which own ~40% of the EV-maker.

Share this!

Recent Business & Markets stories

Business & Markets

| June 11, 2024Unpacking Apple’s AI reveal

🍏🤖 Yesterday, at its annual Worldwide Developers Conference, Apple revealed its long-awaited generative AI strategy – a software update called Apple Intelligence.

Business & Markets

| June 10, 2024GM wants to use Costco to sell more EVs

🚗 GM has a secret weapon it believes will help it sell more EVs – Costco, which apparently does sell everything.

Business & Markets

| June 7, 2024Microsoft’s Inflection deal is under investigation

🤖🔍 The FTC is reportedly investigating whether Microsoft channeled Mr. Deeds’ butler and structured its $650M deal with AI startup Inflection to avoid a gov’t antitrust review (very sneaky sir).

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete