ServiceTitan🤝Public markets

Image: Giphy

ServiceTitan was introduced to the public markets yesterday, in a titanic meeting whose outcome could end up servicing other venture-backed tech companies sitting on the IPO sidelines.

Shares of the company, a software provider for tradespeople, rose 42% in their Nasdaq debut.

- ServiceTitan sold shares at $71 apiece, above the expected range of $65–$67, while the stock opened and closed at $101/share. Last week, the company anticipated a sale price of $52–$57/share.

- Based on the closing price, the company was valued at ~$9 billion.

Why now? For ServiceTitan, going public was less about timing the market and more about avoidance (sound like any past relationships?).

In 2022, the company agreed to “compounding ratchet” terms as part of a funding round valuing it at $7.6 billion. In simple terms: ServiceTitan owed some investors penalties, in the form of stock, every quarter an IPO was delayed past May 22, 2024.

👀 Looking ahead…IPOs have started to tick back up following the SPAC boom-and-bust cycle of 2020-2021. And ServiceTitan’s successful debut – in addition to Reddit and cybersecurity software firm Rubrik’s performances since going public earlier this year (a ~5x and ~2x increase in share prices, respectively) – could drive more venture-backed tech companies off the IPO sidelines.

Share this!

Recent Business & Markets stories

Business & Markets

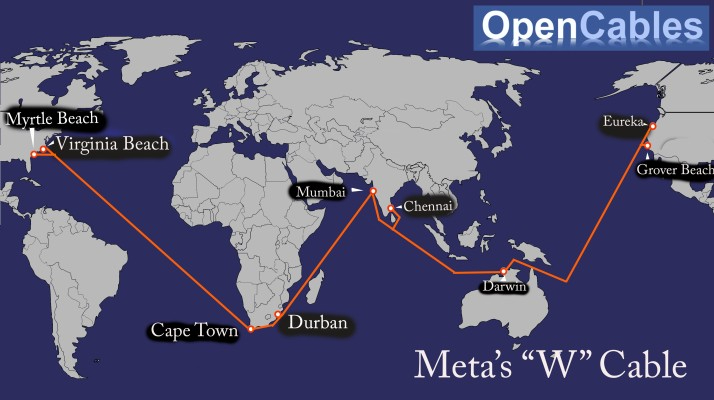

| December 3, 2024Meta is reportedly building a massive underseas cable

🌐 Meta, the second-biggest driver of internet traffic globally, is in the early stages of building a ~25,000 mile-long underseas cable that could cost as much as $10 billion.

Business & Markets

| November 26, 2024Kodak is retiring its employee pension plan

📸💰 Kodak is preparing to terminate its US pension plan to access the fund’s surplus, with the camera company once again arriving late to a broader trend of replacing pensions with 401(k)s.

Business & Markets

| November 21, 2024Target earnings: not quite a bullseye

❌🎯 Target earnings = not quite a bullseye. In fact, they were, as Bob Uecker would say, juuuuuuust a bit outside. The retailer reported poor Q3 results, including its biggest earnings miss in 2 yrs.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete