Analysts after Tesla’s annual sales report

Image: Yarn

Tesla yesterday revealed its sales dropped last year for the first time in over a decade.

- The EV-maker delivered 1,789,226 vehicles worldwide during 2024, a slight decline from 1,808,581 in 2023 (~1%).

- Shares fell 6% yesterday on the news.

The Eras Tour: Tesla version

For Tesla, last year was a tale of two eras – pre-Election Day and post-Election Day.

The EV-maker’s shares were effectively the same price at the start of January 2024 and Election Day 2024, after seesawing throughout the year as sales fell amid increased competition.

But ever since America cast its ballots on November 5, shares have been on a tear, hitting a record in mid-December and ending the year up 63%.

Sales have also ticked back up – though largely driven by promotions, such as interest-free financing and free Supercharging. These deals pulled a Greg Jennings and put the team on their back in Q4; the company turned in a record performance, delivering 495,570 vehicles, a 2% jump from the year prior (but still below analysts’ expectations).

💰 The importance of EV sales: Tesla’s future plans, such as Optimus and the Cybercab, will require large investments to come to fruition (a projected $10+ billion this year alone). This capital is largely expected to come from the company’s vehicle sales.

Share this!

Recent Business & Markets stories

Business & Markets

| December 18, 2024Colorado residents can drive an EV for technically free

🚘👌 A Denver Fiat dealership is offering a 27-month lease on a 2024 Fiat 500e for $0/month and $0 down, as the automaker’s parent seeks to accumulate zero-emission credits.

Business & Markets

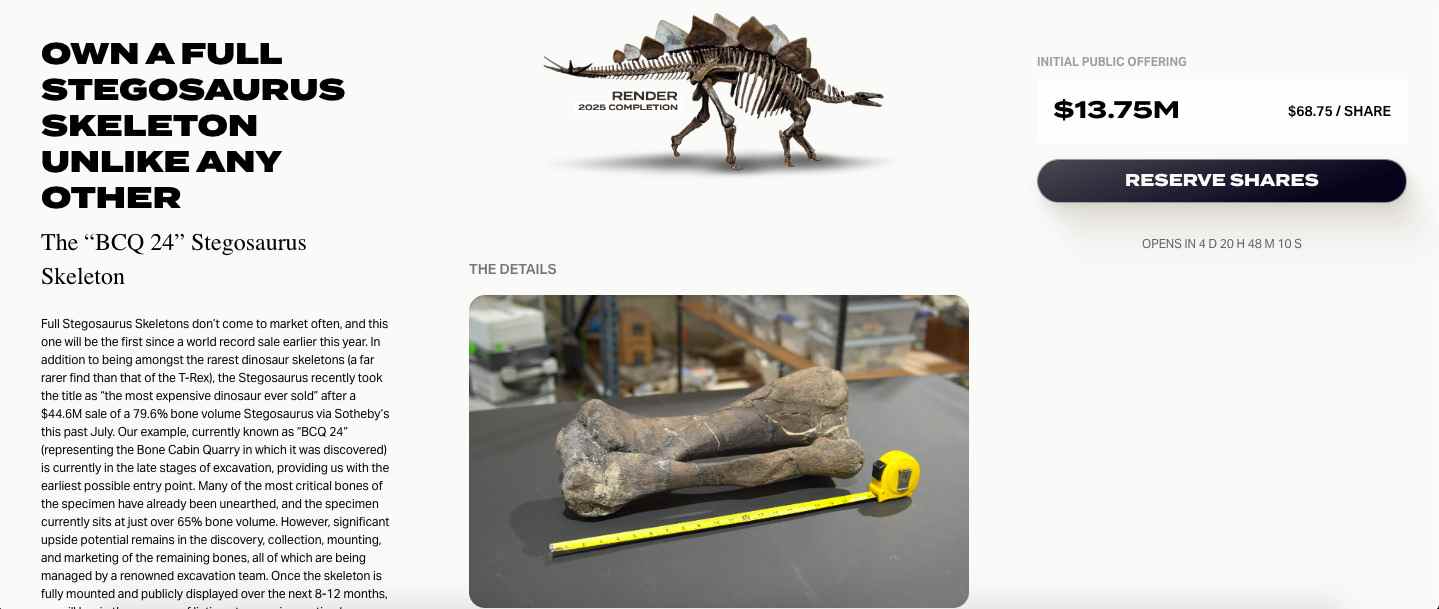

| December 16, 2024Anyone could soon own a piece of a dinosaur

🦕💰 Rally, an alternative asset investment platform, is launching an IPO for a stegosaurus skeleton later this month.

Business & Markets

| December 13, 2024ServiceTitan🤝Public markets

🧰📈 ServiceTitan was introduced to the public markets yesterday, in a titanic meeting whose outcome could end up servicing other venture-backed tech companies sitting on the IPO sidelines.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete