BNPL services are expanding fast

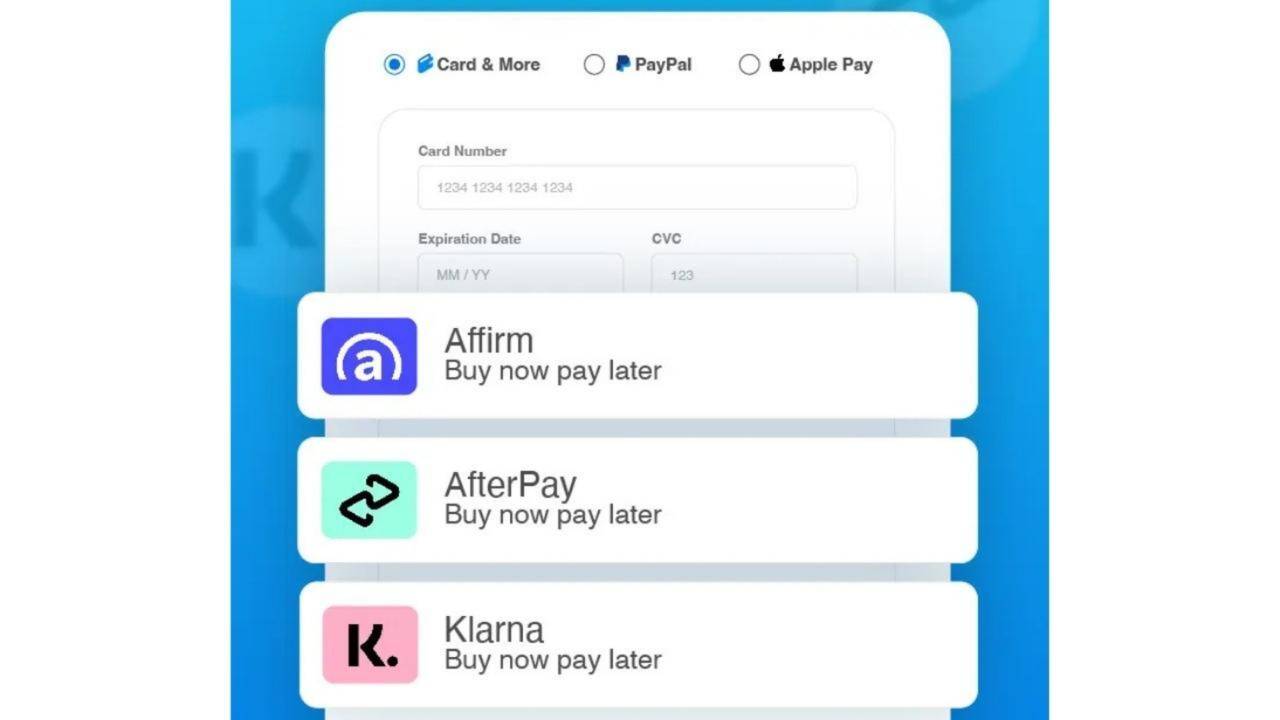

Image: SamCart

Buy now, pay later (BNPL) services were introduced years ago as a handy way to upgrade your phone early, or splurge on a birthday experience.

Fast forward to today, and BNPL has quietly become a budgeting tool for everyday life, with a growing number of Americans using the services for groceries, gas, and other essentials.

By the numbers

The total number of BNPL users in the US currently stands at 91.5 million, up from 86.5 million in 2024, with the average loan amounting to $135 over six weeks, according to Capital One Shopping Research.

- Among those US users, a record-high 25% say they use BNPL services to pay for groceries, up from 14% last year, per a recent LendingTree survey.

Delinquencies are also on the rise. More BNPL users are embracing the “Buy now, worry later” mantra, with a record-high 41% reporting at least one late payment this year. That figure is up from 39% in 2024 and 34% in 2023.

At the same time, most BNPL loans aren’t reported to credit bureaus, creating what regulators call “phantom debt” and forcing US lenders to assess risk without seeing the full picture.

Looking ahead…Analysts say any further increase in BNPL delinquency will likely have spillover effects on other consumer credit products, including auto loans, student debt, and credit card balances.

Share this!

Recent Business & Markets stories

Business & Markets

| November 18, 2025The cost of holiday cheer is climbing

Shoppers looking to decorate their homes this holiday season may find a surprise or two on the shelves, and none of them involve voyeuristic elves.

Business & Markets

| November 18, 2025Unpacking the White House’s proposal for 50-year mortgages

Owning a home has long been part of the American dream.

Business & Markets

| November 13, 2025AI is boosting ad revenue growth

AI truthers have a new arrow in their quiver when participating in debates over the technology’s usefulness.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete