401(k)s Could Be Changing Soon

Image: Giphy

Earlier this week, the House overwhelmingly passed (414–5) a bill that would change the design of 401(k)s and similar defined contribution retirement plans, with the aim of improving savings opportunities for workers. It’s now headed to the Senate.

💸📈 Some of the proposed changes…

- Required auto-enrollment: Any employer (with some exceptions for new and small businesses) introducing new retirement savings plans would be required to auto-enroll new employees into them, when eligible, at a pretax contribution of 3% of the employee’s salary. This level would increase annually by one percentage point up to at least 10%, but no more than 15%.

- For those still paying student loans: The bill provides a way for employers to incentivize saving for retirement by allowing companies to provide contributions to a worker’s retirement plan that match student loan payments.

- For those 50 and above: The plan would increase how much savers can contribute if they’re near retirement, and push back when retirees are mandated to pull money from their accounts.

📸 Big picture: Roughly half of American households are at risk of seeing their standards of living decline after retirement because of a shortfall in savings, according to Boston College’s Center for Retirement Research.

+In the know: The S&P 500 has historically averaged a 10.5% annual return. Using this number, if you invest $100/month into an index compounded annually for 45 years, you’d have more than $1 million sitting in your trading account. Bump that up to $500/month and we’re talking more than $5 million. (You can do your own compound interest calculations here. There’s a reason Einstein called it “the eighth wonder of the world.”)

Share this!

Recent U.S. stories

U.S.

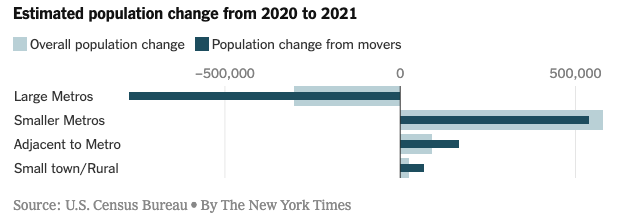

| March 25, 2022America’s Population is a-Changin’

🇺🇸 The US saw its largest death spike in more than a century in the first year of the pandemic, according to Census Bureau data published yesterday.

U.S.

| March 23, 2022The Impact of the Student Loan Payment Pause

🚫💸 Student-loan borrowers were spared $195 billion in loan payments since the federal gov’t froze them at the onset of the pandemic, according to a report released Tuesday by the Federal Reserve Bank of New York.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete