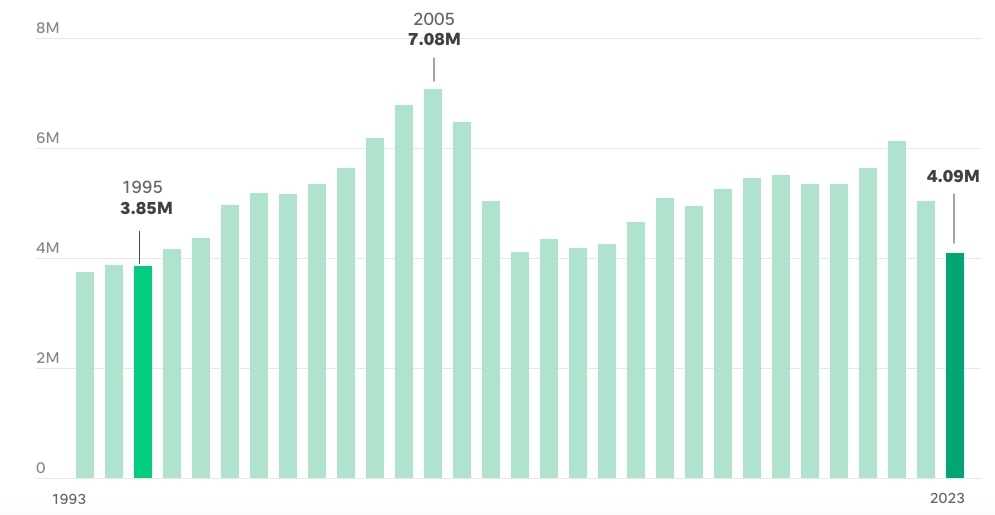

US home sales are at its lowest level this century

Image: NAR/USA Today

In 2023, sales of existing US homes fell to the lowest level in nearly three decades, as elevated interest rates and rising prices made homes less affordable, per a new report from the National Association of Realtors.

The NAR found sales of previously owned homes declined by 19% last year to reach 4.09 million. That figure, which represents the lowest total since 1995, is down sharply compared to the ~5.5 million average annual pace over the previous eight years.

- At the same time, median US home prices rose to a record $389,800 in 2023, driving overall home affordability to its lowest level since the NAR began tracking such data in 1989.

Driving the trend… Analysts say last year’s decline in home sales and increase in prices can be attributed to two main reasons:

- The Fed’s recent historic streak of interest-rate hikes, which are reflected in mortgage rates (currently over 2x higher than the start of 2022).

- A lower supply of available homes, which drives up prices.

But there are signs that home-buying activity is picking back up. US mortgage purchase applications rose this month to the highest seasonally adjusted level since July, per the Mortgage Bankers Association. The move is attributed to a recent decline in mortgage rates since October, with rates projected to fall even further and dip below 6% by the end of this year.

📊 Flash poll: Do you plan to buy or sell a home in the next year?

See a 360° view of what media pundits are saying →

Sprinkles from the Left

- Some commentators argue that the Federal Reserve should bear the brunt of the blame for America’s current housing situation, since their decision to raise interest rates to tame inflation has eventually resulted in higher mortgage rates and home prices across the board.

- Others contend that the real problem in the US housing market is a persistent lack of supply in both housing for sale and for rent, which can largely be blamed on the difficulty the construction industry is having attracting American workers.

- “The Fed Has Put Our Housing Market in Jeopardy” –Daniel Alpert, NY Times

- “The US Needs More Housing. Americans Don’t Want to Build It.” –Karl W. Smith, Bloomberg

- “America Has a Mortgage Problem” –Peter Coy, NY Times

Sprinkles from the Right

- Some commentators argue that most American homeowners are both richer and poorer than they understand – richer because their mortgage rates are likely ~2x lower than new homebuyers, and poorer because home prices won’t stay elevated once the normal amount of people start to sell.

- Others contend that President Biden’s economic policies have forced the Federal Reserve to sharply hike interest rates, putting the American dream of home ownership out of touch for many people, especially young voters.

- “Most homeowners are both richer and poorer than they understand” –Megan McArdle, WaPo

- “Bidenomics has destroyed the American dream” –Washington Examiner Editorial Board

- “Will hotter housing market help renters?” –Pittsburgh Tribune-Review Editorial Board

Share this!

Recent Discussion stories

Discussion

| January 19, 2024The US labor market is giving mixed signals

💼 While the US labor market has shown surprising resilience in recent months, some indicators have analysts warning that the future outlook isn’t quite as rosy.

Discussion

| January 17, 2024Unpacking the results of the Iowa caucus

🗳️🐘 Former President Trump was the clear winner of Iowa’s first-in-the-nation GOP caucus, which serves an important role in determining who has a realistic shot at becoming president.

Discussion

| January 12, 2024Is AI development moving too fast?

🤖 OpenAI’s GPT Store, where users will be able to share and monetize customized versions of ChatGPT (similar to Apple’s App Store), officially launched this week. And it’s causing some to think AI development is moving too fast.

You've made it this far...

Let's make our relationship official, no 💍 or elaborate proposal required. Learn and stay entertained, for free.👇

All of our news is 100% free and you can unsubscribe anytime; the quiz takes ~10 seconds to complete